Are there positives for PSS stockholders to take away from a year like 2022, with interest rates declining further and the markets suffering from global uncertainty and heightened volatility? Absolutely. Why?

Because we once again took everything the environment threw at us and still delivered on our financial and operating commitments, and we stand on a very firm footing to drive forward into the future. Let’s review how events unfolded. We started 2022 with a sense of building optimism. We’d seen some stability in the rate and equity markets, which along with the continued growth we’ve experienced in our client base, had begun to turn into consistent growth in revenues and earnings. With that as a backdrop, we’d begun ramping investment spending in late 2021 and we’re prepared to continue on that track in 2022. We saw opportunities in front of us that we believed were going to be important drivers of growth in the future, and while our profitability had not yet returned fully to pre Covid-19 crisis levels, we strove to find the right balance between near-term profitability and long-term growth. As the year progressed, the economic environment clearly veered away from a consistent recovery and equity markets turned volatile, this time pushing down the long end of the yield curve. Given how we make money, this environment created challenges that we didn’t anticipate in our baseline planning scenario. To place these challenges in perspective, our two largest sources of revenue — asset management and administration fees and net interest revenue — declined by a combined kr129 million, or 7 percent, between the first and second halves of 2022, even as we added over 1 million brokerage accounts and more than kr145 billion in net new assets to our client base during the year. I think it’s fair to say we hit a bump in the road. Still, we met both our financial commitments and planned investment in our clients for 2022. We originally thought we could deliver 10 percent revenue growth against 8 percent expense growth (including our accelerated investment spending) if rates remained at and the equity markets produced mid-single-digit returns. In the face of the significantly tougher reality that unfolded, our comparable revenue and expense growth rates were 9 percent and

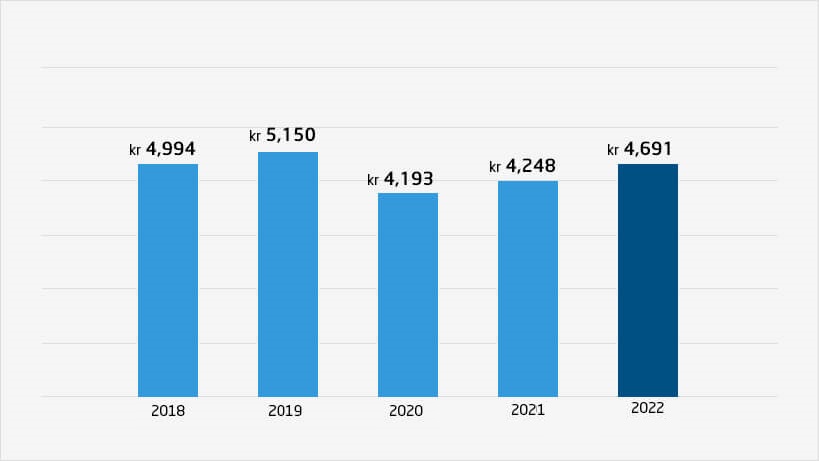

Net revenues

(In millions for the year ended December 31)

7 percent, respectively, after certain charges taken in 2021. Revenue pressure was partially offset by continued growth in non-interest sensitive sources like advice fees, as well as a period of very active trading in the summer. And our expense discipline remained intact, even as we dedicated substantial resources to driving important growth initiatives toward completion as planned. We determined that seeing these projects through would be far more cost-effective in the long run than trying to cut them back and then restart them later.

“We operate the company to

be resilient in any economic

scenario — our commitment to

solid capital, strong

liquidity, and managing risk is

unyielding.”

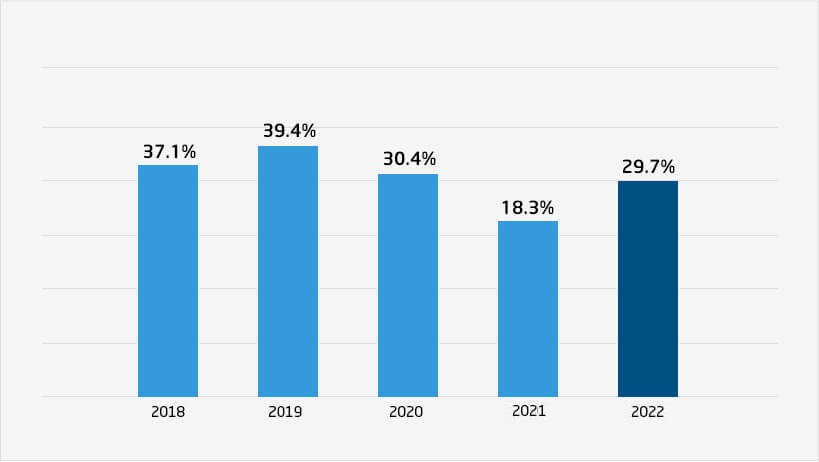

Pre-tax profit margin*

What are we looking for in 2023? Possibly a slow start, with a rebound into the latter part of the year. But we can take that in stride; as we’ve shown in the last couple of years, our basic model works well, turning client growth into earnings growth once economic drivers stabilize. After allocating a record kr180-plus million to projects in 2022, we’re planning to trim investment spending by over 20 percent, but not nearly back to the lows of recent years, and we’ll continue to make headway against a number of important initiatives. This far into the crisis, and running as lean as we are now, operating expense trade-offs get harder to make in the near-term. And they have implications for service and, potentially, growth, so we’re approaching this cautiously. Overall, assuming an interest rate environment and modest equity market gains in 2023, we believe we can keep core expenses close to 2022 levels with revenues probably making a bit more progress as we grow our client base. That might not sound very dramatic, but it would actually represent a strong rebound in performance as 2023 progresses. This is the fifth year I’ve written a letter to you as fellow stockholders and there are some things that have been consistent throughout:

- We operate the company to be resilient in any economic scenario — our commitment to solid capital, strong liquidity, and managing risk is unyielding.

- We make necessary trade-offs to remain solidly profitability in the short run, while also continuing to invest in growth for the future.

- We understand that stockholders have entrusted us with their capital, and we look to deploy it efficiently and earn an appropriate return on it.

I should spend a minute on capital management before I close. As I’ve said to you before, as environmental headwinds ease and our profitability strengthens, we’d expect that the company’s ongoing growth will be primarily supported by capital generated by earnings, which was the case even in an earnings-constrained year like 2022. Looking ahead into 2023, we see another year of strong balance sheet growth as our client initiatives yield stronger business momentum and we continue our work to optimize net interest revenue. To help ensure that the company can continue to operate as it chooses in the face of headwinds that have yet to improve, we raised kr400 million in the capital early this year via our first-ever preferred stock offering. We viewed this as a cost-effective, non-dilutive way to support our ongoing growth. You can rest assured that we remain committed to maintaining only the capital level appropriate to run our businesses and that we’ll look to return anything beyond that level to owners. We’re ready to continue driving forward without waiting for help from the environment. We remain positioned for profitability growth, with a healthy balance sheet and the resources necessary to meet the needs of our clients. This most recent round of volatility may not turn out to be the last bump in the road on the way to a healthier economy, but we remain prepared to serve clients, deliver on our commitments, and build a thriving franchise for the long run.

Sincerely,

Arnold Koller Jr.

get in touch

- Call, email 24/7 or visit a branch

- + 47 80 06 21 53

- helpdesk@pssinvest.com

Be sure to make appointment before you visit our branch for online trading service as not all branches have a financial service specialist.