PSS 24hr Support Center

FAQs

Straightforward answers and helpful guidance

We make the account opening procedure as simple as possible.

Before you begin, you’ll need:

Your Passport

These are the steps you’ll follow:

- Provide your information.

- Create a login ID and password.

- Accept the Terms and Conditions.

- Fund your account.

There is no fee to open or maintain an account with PSS and most accounts have no minimums. There is also no charge to work with a PSS Financial Consultant. Although other account fees, fund expenses, and brokerage commissions may apply, we believe in keeping our fees low as a way to provide greater value to you. In fact, our fees are some of the lowest in the industry. We strive to keep fees low so that you have more to invest.

An investment account is an arrangement between you and PSS. Once your account is set up, you can deposit funds and place orders to buy different assets through the account, and the transactions will be carried out on your behalf. You have the freedom to invest in whatever you choose—stocks, forex, commodities, bonds, ETFs, and more—as you own all the assets in your account.

At PSS, we believe in putting investors first. A strategic realignment which focus on digitalization for customers starts from understanding that customers are what makes of day-to-day business reality on a B2C relationship (online or offline). Guided by PSS code of conduct, we prioritize building long term relationships with our customers under following three objectives:

- Easy accessibility and fast processing

- Best value with competitive pricing

- Personalized support for positive experience

Our wide selection of investment products provides you with numerous choices in building a diversified portfolio to help you reach your goals.

Investment Product : Stocks

What it is : A stock represents a share in the ownership of a company, including a claim on the company’s earnings and assets. As such, stockholders are partial owners of the company.

Why you may want it : Stocks are fundamental to nearly every portfolio and have historically outperformed most other investments over time.

Investment Product : Forex

What it is : The Foreign Exchange market, also known as Forex or FX, is where financial institutions facilitate the buying and selling of foreign currencies. It is referred to as the closest market to ideal competition, notwithstanding the market manipulation by central banks.

Why you may want it : The Forex market is highly characterized by the volatility and liquidity of currencies moving in strong trends. The market is accessible 24 hours, while information affecting the market is easily accessible to everyone eliminating information inequality.

Investment Product : ETFs

What it is : An ETF, or exchange-traded fund, is an investment fund or portfolio of securities that holds assets like stocks, bonds, or commodities, generally designed to track an index.

Why you may want it : In addition to adding diversity to your portfolio, ETFs typically have higher daily liquidity and lower fees than mutual fund shares, making them an attractive alternative for individual investors.

Investment Product : Commodities

What it is : A commodity is another class of assets just like stocks and bonds. However, they are products that come from the earth, such as cotton, oil, gas, corn, wheat, oranges, gold, and uranium.

Why you may want it : This asset class adds diversification to a portfolio and is typically considered defensive because of its tendency to perform well when financial assets (e.g., stocks and bonds) perform poorly.

Investment Product : Bonds

What it is : Bond are fixed-income securities that are issued by corporations and governments to raise capital. The bond issuer borrows capital from the bondholder and makes fixed payments to them at a fixed (or variable) interest rate for a specified period.

Why you may want it : Since bonds are considered to be essentially free of credit risk, they provide a secure and predictable source of income, and can be a means of preserving capital. Money that investors want to keep safe from default and stock market risk is often invested in government or investment grade corporate bonds.

Investment Product : Cryptocurrencies

What it is : Cryptocurrencies are encryption techniques used to regulate the generation of units of currency and verify the transfer of funds, operating independently of a central bank.

Why you may want it : Cryptocurrency is considered as one of the most volatile investment products with 24/7 trade accessibility.

We take a modern approach to investing. We believe in asking questions, being engaged, and taking ownership of your future. We measure ourselves not only by what we do, but by how we do it. Every action and decision is based on building trust and seeing things through the eyes of our clients.

If you lose cash or securities from your account due to unauthorized activity, we’ll reimburse you for the cash or shares of securities you lost. We offer you this protection, which adds to the provisions that already govern your account, in case unauthorized activity ever occurs and it was through no fault of your own.

PSS is a member of the Investor Protection Corporation (“IPC”), which protects customers of its members up to €500,000 (including €250,000 for claims for cash).

Additionally, PSS provides each client €98.5 million worth of protection for securities and €5 million of protection for cash through supplemental coverage provided by UK insurers. In the event of a brokerage insolvency, a client may receive amounts due from the trustee in bankruptcy and then IPC. Supplemental coverage is paid out after the trustee and IPC payouts and under such coverage each client is limited to a combined return of €102 million from a trustee, IPC and UK insurers. The PSS supplemental coverage has an aggregate limit of €500 million over all customers. This policy provides coverage following brokerage insolvency and does not protect against loss in market value of securities.

Yes. PSS pays interest on eligible free credit balances in your account for premiere account. Simple interest is calculated on the entire daily balance and is credited to your account daily. This service is subject to the current PSS rates and policies, which may change without notice.

A margin account allows you to borrow against your eligible securities and can be helpful when you need to buy more securities, take advantage of timely market opportunities, or give yourself a source of overdraft protection. However, margin borrowing is not for everyone, and you should consider all risks and limitations before selecting this option. A cash account only allows you to use the cash that you deposited to buy stocks, forex, commodities, bonds, ETFs, or other investments. This type of account presents less market risk as you are only investing assets that you already have but can be more limiting when timely opportunities or emergencies arise.

High is the maximum BID over a period.

Low is the minimum BID over a period.

Thus minimum ASK is equal to Low + Spread, and maximum ASK is equal to High + Spread.

The Stop Loss and Take Profit of an open Buy position will be executed when the BID price in the quotes flow becomes equal to the order level.

The Stop Loss and Take Profit of an open Sell position will be executed when the ASK price in the quotes flow becomes equal to the order level.

The Pending orders Buy Limit and Buy Stop will be executed when the ASK price in the quotes flow will be equal to the order level.

The Pending orders Sell Limit and Sell Stop will be executed when the BID price in the quotes flow will be equal to the order level.

For example, you are supposed to open a Sell position in EURUSD at 1.2250 and place a Stop Loss at 1.2340 level and Take Profit at 1.2190 level.

You should remember that a Sell position is closed by a Buy, and we buy at the Ask price, so a Stop Loss will be executed when the minimum Bid becomes equal to 1.2338 + Spread (2 pips in EURUSD). Also you should remember that the High in the chart is the maximum Bid. So, if you see High = 1.2338 or above, your Stop Loss must be executed.

Spreads can be seen in the window Market Watch in the column Spread. If the spread column is not active in the window, it can be displayed using the right mouse click and the selection of Columns and then Spread.

PSS MT4 Client Terminal is on UTC+2 with daylight saving time.

The size of the open positions of the participating currencies can be found in the Toolbox window in the Exposure section, which includes a graphic expression.

In all currency pairs, margin is calculated in the USD equivalent of the base currency, but not as a fixed amount in USD. In general, margin for locked positions of the same size is calculated as follows:

Lots * hedged margin * (open price1+open price2),

where:

Hedged Margin =

Open_price1 – First position open price (current rate of the base currency in USD at the moment of position opening in cross rates);

Open_price2 – Second position open price (current rate of the base currency in USD at the moment of position opening in cross rates);

In Gold, margin is calculated in percentage of total value of locked positions. In general, margin for locked positions of the same size is calculated as follows:

Lots * contract size * hedged margin * (open_price1+open_price2),

where:

Hedged Margin =Contract size – First lot contract size;Open_price1 – First position open price;Open_price2 – Second position open price;

Swap rates are open spot Forex positions held at the end of a Trading Day at 24:00 trading time on exchange. The platform will be rolled over to a new Value Date on a Tom/Next basis immediately after the change of the trading day.

The Broker is entitled to close all or part of your open positions at the CURRENT PRICE if the equity is less than 45% of the necessary margin.

It is called Over-loss.

For example, B = balance of customer’s account, M = margin, and L = floating loss (in absolute value).

So, Over-loss occurs if L – (B – M) > 55% x M, or B – L < 45% x M.

A Sell position is closed by a Buy and we buy at the Ask price. The Take Profit will be executed when the minimum Bid becomes equal to 1.2188 (1.2190 – Spread). At this moment, the minimum Ask is equal to (minimum Bid + Spread) 1.2190. You should remember that the Low in the chart is the minimum Bid. So, Take Profit will be executed only when the Low at the chart will reach at least 1.2188 (order level – Spread).

«Trailing Stop» is the following algorithm to control Stop Loss orders:

- No actions are taken until the moment when the position enters the profit area on X pips («Trailing Stop» level).

- Once the profit exceeds the «Trailing Stop» level, an order to place the Stop Loss X pips away from the current price (in this case on the break-even level) is sent to the server.

- Once a quote comes and the distance between the current price and the placed Stop Loss order is more than X pips («Trailing Stop» level), an order to modify the level of this order and place it X pips away from the current price is sent to the server.

Note: «Trailing Stop» works on the Client Terminal (whereas Stop Loss and Take Profit work on the server). Consequently, Trailing Stop functions when the Internet and PSS MT4 Client Terminal are active only. When PSS MT4 Client Terminal is not active, only Stop Loss, if it was placed by the «Trailing Stop» earlier, will work.

Yes, hedging is enabled in PSS MT4 Client Terminal.

Yes, PSS MT4 Client Terminal offers the possibility to use trade alerts. You don’t need to spend hours sitting near the monitor and watching price movement. Just set an alert to update you on trade events in the financial markets. The trading system will notify you with a sound or an email at the moment of any trade event.

Yes. You can download MT4 mobile terminal from our website, www.pssinvest.com.

Click the right mouse button on any instrument in the «Market Watch» window (PSS MT4 Client Terminal / Menu «View» / «Market watch») and choose in the menu «Show All».

In order to download quotes from the terminal, you should:

- Update the terminal. In order to do it, download PSS MT4 Client Terminal from our website and install it over the older version.

- You will not be able to import the quotes via Live Update.

- Increase the maximum quantity of bars in PSS MT4 Client Terminal settings on the basis that one day in the History contains 1,440 M1 bars:

- MT4 / Tools / Options / Charts / Max bars in history.

- Go to the History Center in PSS MT4 Client Terminal: MT4 / Tools / History Center.

- Choose the instrument you are interested in (e.g. click EURUSD twice) and click Download.

- As a result, PSS MT4 Client Terminal downloads the history of M1 quotes from our History Center and imports them to MT4 time frames.

The PSS MT4 Client Terminal includes the MQL5 Wizard, which allows to quickly generate the code of an Expert Advisor (Expert Advisor builder). With MQL5 Wizard, knowledge of programming languages is no longer a prerequisite for creating trading robots. In the past, it really was an impassable obstacle to create automated trading strategies, but the release of the MQL5 Wizard changed the situation radically. With this new expert advisor builder, the programming experience is not required – the application will do all the necessary work to create free Expert Advisors.

Virtually every PSS MT4 Client Terminal Expert Advisor consists of three modules – trading signals, money management and trailing stops. And because the modules can be implemented in various ways, there are a lot of possible combinations of Expert Advisors. Thus, every trader can construct trading robots to their liking. It is only necessary to specify the desired parameters and select the necessary components. Then the Expert Advisor Builder will do the rest. The creation of free trading robots has never been so quick and simple. Only four clicks – and the free Expert Advisor will be ready to trade according to a user-defined strategy!

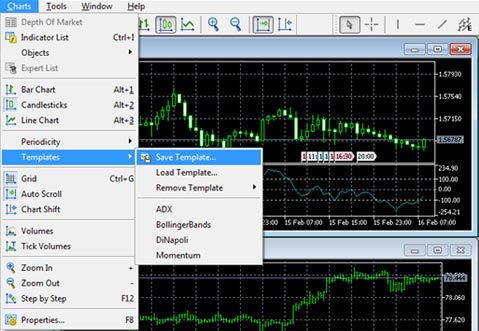

Yes, there is a way. All you have to do is open all the indicators you want to save and use with other charts and save it as a template under the Charts > Template menu.

The web-traffic size that MT4 takes is formed of several factors:

- The number of ticks received. Every tick takes 14 bytes of information. A large number of ticks received at the same time can be squeezed and thereby take smaller web-traffic size. Above all, ticks are packed in TCP package which takes about 128 bytes. The more the ticks’ intensity is, the less odd packages you need, and this also reduces the web-traffic size. Thus, the more financial instruments you keep in the Market Watch window and the more traffic size is in each financial instrument, the more traffic is taken. But, the traffic does not grow in direct ratio to the instruments’ intensity, but runs a level by traffic squashing.

- The volume of uploaded data in open instruments or in time frames. Once the chart is open or the time frame is changed, history data is automatically uploaded from the moment of the previous data session and it takes 44 bytes for each uploaded bar.

- News data feed.

- History requests, 224 bytes for each record.

- Trading requests.

- Inside information (crash logs).

Basic rule: If you want to reduce traffic consumption, you should close all unnecessary charts and delete all unused financial instruments from the Market Watch window.

In PSS MT4 Client Terminal, there are: 21 timeframes 38 technical indicators 39 graphical objects 4 scaling modes 17 styles of displaying Custom Indicators.

The integrated development environment MQL5 is responsible for the development and use of Expert Advisors, custom indicators and scripts. It includes MetaEditor, Strategy Tester and MetaQuotes Language 5 (MQL5).

Yes. Together with the release of the PSS MT4 Client Terminal, MQL5.com was also launched. MQL5.com is the place where MQL5 developers and their clients (traders) can interact. This community contains a lot of useful information for developers: complete MQL5 documentation, articles on how to develop and use automated forex programs, Code Base of ready-to-use Expert Advisors and technical indicators. The Forum provides the means for communication with other MQL5.com community members, asking for advice and solving problems together.

In order to start the process of terminal deletion from the PC, one should launch the “Uninstall.exe” file in the folder, where the client terminal is installed, or execute the “Uninstall” commands in the corresponding group of programs in the “Start” menu. The following window will be opened as soon as it is done:

The folder from which the trading terminal will be removed is displayed at this window. Also, there is the “Delete user personal data” option. If it is checked, then all the user’s information (symbols history, mail, MQL5 programs, terminal settings, etc.) will be deleted together with the permanent files of the terminal.

If one is sure to continue the deinstallation of the client terminal, it is necessary to press the “Next” button. The deletion process will be started as soon as it is done:

In order to finish the deinstallation, one should press the “Finish” button.

Yes, this is possible for the VPS platforms where PSS MT4 Client Terminal is supported.

The PSS MT4 Client Terminal installation program determines the type of operation system automatically and installs a necessary version according to a bit count. It should be noted, though, that 64-bit Windows systems involve necessary RAM memory and are more preferable for the installation.

PSS offer 4 different ways for you to make deposits and withdrawals.

- Wire Payment is a way of making deposits and withdrawals using international bank wire transfer. You can go to your ibank page and select wire payment to get an overseas bank deposit account where you can transfer your fund to.

- Card Payment is a way of making deposits and withdrawals using your credit or debit card. You can go to your ibank page and select card payment to process your credit or debit card to make a deposit.

- PayPal Payment is a way of making deposits and withdrawals using your PayPal account. You can go to your ibank page and select PayPal payment to transfer your fund.

- Crypto Payment is a way of making deposits and withdrawals using your Cryptocurrency such as Bitcoin, Ethereum, Bitcoin Cash and Litecoin. You can go to your ibank page and select Cryptocurrency payment to transfer your fund to your Cryptocurrency wallet at PSS. Then, the coin will be transferred to your trading account after it is exchanged to US Dollar or Euro at the market rate.

- Wire PaymentYour funds are usually posted to your trading account within two days of the completion of wire payment.

- Card PaymentYour funds are usually posted to your trading account instantly with a successful credit or debit card processing.

- PayPal PaymentYour funds are usually posted to your trading account instantly upon the completion of PayPal payment.

- Crypto PaymentYour funds are usually posted to your trading account instantly upon the completion of Crypto payment.

You can go to your ibank page and select any of following options to withdraw your fund.

- Wire PaymentIt usually take less than two days for you to get your fund back to your bank account.

- Card PaymentIt usually take less than one day for you to get your fund back to your credit or debit card.

- PayPal PaymentIt usually take less than 10 minutes for you to get your fund back to your PayPal account.

- Crypto PaymentIt usually take less than 10 minutes for you to get your fund bank to your Cryptocurrency wallet.

PSS charges no fee for deposit.

Accounts funded via credit or debit card may be restricted to receiving withdrawals via credit card. Initial deposits made with a credit or debit card upon request may require a recent statement or a copy of the card to confirm ownership.

The minimum amount to make a deposit is € 1,000 or US$ 1,000. For Cryptocurrency payment, the minimum amount is 0.1 Bitcoin, 1 Ethereum, 1 Bitcoin Cash and 1 Litecoin.

There is no maximum amount for deposits using wire payment, PayPal payment and Crypto payment. However, there is a monthly deposit limit for card payment and in amount of € 5,000 or US$5,000 within one calendar month.

There is no minimum requirement a withdrawal.

There is a maximum daily withdrawal limit of € 50,000 or US$50,000. For any withdrawal request above the daily maximum withdrawal limit will be forwarded to the next business day and such amount will be processed to withdraw the next day.

For example, if a client submits a withdrawal request of $100,000 on the 1st day of May. $50,000 will be withdrawn from the account on the 1st day of May and another $50,000 will be withdrawn on the 2nd day of May.

PSS accepts funds in multiple currencies. If you send foreign currency to your Euro or US dollar account, PSS will convert it to Euro or US dollars at an exchange rate specified and deposit to your trading account.

The most common risk management tools in trading are the limit order and the stop loss order. A limit order places restriction on the maximum price to be paid or the minimum price to be received. A stop loss order ensures that a particular position is automatically liquidated at a pre-determined price in order to limit potential losses should the market move against a trader’s position. Contingent orders may not necessarily limit your risk for losses.

Traders make decisions using both technical factors and economic fundamentals. Technical traders use charts, trend lines, support and resistance levels, and numerous patterns and mathematical analyses to identify trading opportunities, whereas fundamentalists predict price movements by interpreting a variety of economic information, including news, government-issued indicators and reports, and even rumors. Please see Education to learn more on trading strategies.

Trading with PSS means getting the professional tools, abundant information, and dedicated specialist support of PSS Trading Service—all of which help give you what you need to make informed and timely trading decisions.

Superior customer support

- Convenient Bitcoin DepositsYou can deposit and withdraw using bitcoin.

- Simple and easy access to the marketWe made account opening, deposit and withdrawal procedures as simple as possible.

- Real-time back officePSS provides transparent, real-time reports on all your trading activity.

Superb order settlement

- Tight spreadsWe offer competitive spreads, enabling you to maximize potential profits for our customers.

- Price improvementAt PSS, 82.7% of all orders have settled at a better price for customers.

- Fast and consistent tradesWith automated trading and settlement system, our customers trade quickly and efficiently.

- Adjustable leverageOur customers can change leverage even for opened positions for flexible margin requirement.

Professional trading tools

- Multi-Product PlatformPSS offers a wide array of products on a highly-secured online trading environment.

- One Click TradingYou can trade directly from a chart with one click based on your predefined volume.

- Hedge TradeYou can place a new position in opposite direction to an existing position to be neutral on market volatility.

- Trailing StopYour trading system allow you safeguard profit automatically as market moves in your favor.

- Auto tradingYou can easily develop your own auto trading algorithm directly from your trading platform.

- Trading SignalsYou can copy trades of an experienced dealer in real time.

At PSS, you have access to a wide range of investment management services to help you reach your goals. And you’ll have access to a variety of investment strategies, investment advice, and the ability to regularly monitor and rebalance your portfolio.

The comprehensive investment management services offered at PSS meets all needs in three business sectors; individual and small business customers, institutional customers and corporate customers. This market division allows us to efficiently allocate our company resources to provide specialized services to all customers in each market sector.

Once your account is opened, you will receive an email with your username, password, and instructions for accessing your account.

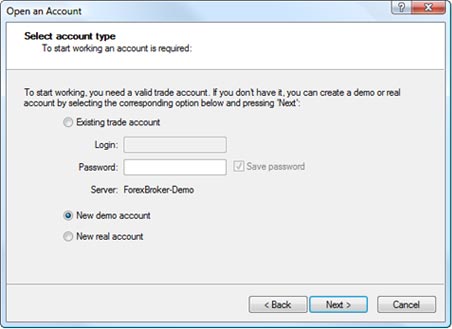

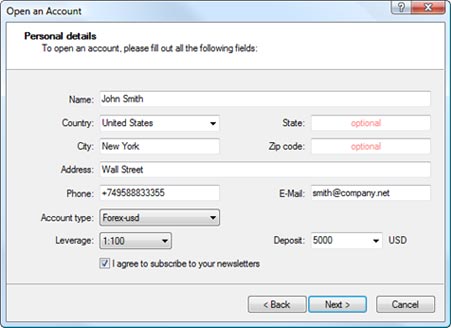

The ” Open an Account” command of the “File” menu or the “Navigator” window context menu should be executed to open a demo account. The process of opening a demo account consists of several steps, which include selecting a server;

- choosing the “New demo account” option in the “Select account type” window;

- specifying your Personal details;

- then waiting for the account to be registered in the specified server.

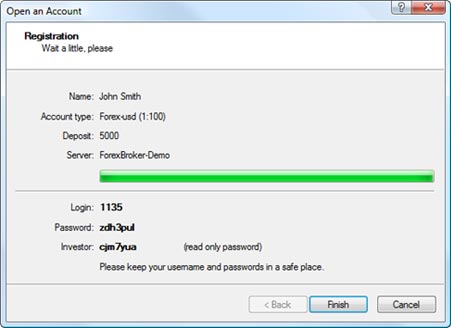

To complete the registration, click “Finish”. An automatic connection to the trade server will be established using this account. Aside from this, the account will appear in the “Accounts” section of the “Navigator” window. If “Cancel” is clicked, the connection to the server will not be established, and the account will not be added to the “Navigator” window; though the account will be opened anyway.

Live accounts are under PSS-Live with icon, ![]() in the “Accounts” section of the “Navigator” window, whereas, demo accounts are under PSS-Demo marked with

in the “Accounts” section of the “Navigator” window, whereas, demo accounts are under PSS-Demo marked with ![]() .

.

The master password lets you trade, and the investor password allows you to view account status without placing or modifying orders. You can place an order to buy or sell only when you login to your account with master account

An investor password for a demo account is generated automatically when the account is opened and it is sent with the main password by the PSS MT4 Client Terminal internal mail. An investor password for real accounts is assigned by the owner of the trading account. To create/change an investor account, you should:

- Click the button “change” in PSS MT4 Client Terminal in the menu “service” / “settings” / “server”.

- Enter the main password (master password) in the “current password” field.

- Put the mark against “change the investor password (read-only)”.

- Enter the new investor password twice. ATTENTION! The new password must consist of not less than five characters and not less than two of the three presentation types – lowercase, uppercase and digits.

- Click “OK”. If everything is done properly, an automatic authorization in the account under the investor password will take place.

After a demo account is opened, the password into PSS MT4 Client Terminal is sent in a message to the internal PSS MT4 Client Terminal mail. Check there, as the message with the password may still be in your mailbox (window “Terminal” / tab “Mailbox”). If you have not found the password in the PSS MT4 Client Terminal mailbox and do not remember it, you may open a new demo account. Passwords to access demo accounts are not restored.

- No Internet connection

- Your terminal build may be old, or you have not logged in to your trading account for a long time. In this case, it is necessary to install the latest version of PSS MT4 Client Terminal from our website.

- Your network port 443 may be blocked and you may have to enter the Internet through a proxy server or use some local network. Then, you should turn to your systems administrator to specify the address of the proxy server and the port to connect the Internet and set it in the terminal settings (menu «Tools» / «Options» / «Server» / put a tick to «Enable proxy server» / press the «proxy…» button / enter the address, proxy server port, login and password).

- Antivirus Firewall software blocks port 443. In this case you should enter PSS MT4 Client Terminal in the list of the allowed programs or open port 443;

- If you still have a problem logging into your system, you may use our online support or send an email to helpdesk@pssinvest.com describing the problems encountered.

- You may have entered an invalid login in PSS MT4 Client Terminal. The login in PSS MT4 Client Terminal is always numeric and does not include any letters.

- You may have entered an invalid password. A password in PSS MT4 Client Terminal consists of not less than five characters and not less than two of three types of representation – lowercase, uppercase and digits. All letters must be Latin. The case of the letters (capital/small letters) is of importance. Perhaps, you may have taken some letter for a digit, or you may have taken a digit for a letter.

- Choose a server for another type of account. For live accounts, choose from the list of servers the «PSS- Live» server, for demo accounts choose the «PSS-Demo». If there is no needed server in the list, it is necessary to install the latest version of PSS MT4 Client Terminal from our website.

There are two ways to access an account in the trading platform: main and investor. Authorization using the main password gives full rights to work with the terminal. In case of investor authorization, you may look through the state of your account, analyze price data, and work with expert advisors, but you cannot perform a trading operation. Most probably, you have used the investor password to access the account. To perform trading operations, you should change the password for the main one in your settings. The investor password for a demo account is generated automatically when the account is opened, and it is sent with the main password by the internal PSS MT4 Client Terminal mail. The investor password for real accounts is assigned by the owner of the trading account.

A message « The trade flow is busy » appears in case of an unsuccessful attempt to perform a transaction (for instance: a client sends the second order while he has not yet received the processing results of the first one), which may occur due to a temporary loss of server connection. In such case, the order is put on the queue at the client’s terminal and the abovementioned message will appear if you try to perform any other operation. To clear the request queue, you should restart the terminal.

- Most probably, the trading session on this instrument is already over or has not begun yet. You may find the trading session schedule in the contract specification for each instrument separately.

- Maybe, the future contract expires soon. It is called the Expiration date. Depending on the liquidity of the instrument, sometimes before the Expiration date, «close only» trading is available for the instrument (close of open positions only). Another future contract with a different ticker is introduced for trading instead of the one traded as «close only». Several days before the «close only» trading, notifications are sent by the inner mail of PSS MT4 Client Terminal.

- When the price reaches the current price of the pending order, the total volume and number of the simultaneously opened positions and pending orders are checked. A pending order will be deleted from the queue to be executed in the following cases:

- the order volume and the volume of the previously opened positions exceed the total volume restriction.

- the restriction of the total number of the simultaneously placed pending orders and open positions is broken.

HOW TO CALCULATE MARGIN REQUIREMENTSLet us consider the formula of margin calculation in the base currency: Margin = Contract / Leverage, where:

Margin – is the collateral;Base currency – the currency quoted first in the pair,

For example:EURUSD – the base currency is EUR;USDJPY – the base currency is USD;GBPJPY – the base currency is GBP;Contract – the contract size in the base currency.

The size of 1 lot is always 100,000 units of the base currency. Consequently, 0.1 lot = 100,000 * 0.1 = 10,000 in base currency, and 0.01 lot = 100,000 * 0.01 = 1,000 in base currency;

Leverage,

For example: leverage 1:500 – 500, 1:100 – 100.After calculating margin in the base currency, it is necessary to convert it into the deposit currency (at the rate of the position opening), i.e. USD, EUR.

Example 1. Calculation of margin on an account with the deposit currency USD:

Trading instrument (Currency pair) = EURUSDBase currency = EURLot = 0.1Contract = 10,000 EUR (100,000 * 0.1 lot)Leverage = 1:100 (100)The rate of EURUSD at the opening position = 1.3540Deposit currency = USD

Calculation:

- Margin = Contract / Leverage = 10 000 EUR / 100 = 100 EUR;

- Then, we convert it into the deposit currency (the USD). If the dollar in the currency pair under consideration is the first one, then the pip value should be divided by the rate, otherwise it should be multiplied:

Margin= 100 EUR * 1.3540 = 135.40 USDMargin is equal to 135.40 USD

Let us consider how to calculate the margin needed to open a position for US Shares and Futures. For US Shares, the leverage is 1:10.

Let us consider the formula for calculating the margin for US Shares:

Margin = (Contract * Price) / Leverage,where:Margin – is the collateral;Contract – the volume of contract. 1 lot is always 100 shares. Consequently 0.1 lot = 100 * 0.1 = 10 shares;Price – the price of CFD at the position opening;Leverage 1:10 – 10.

Stop loss order is to limit your loss when the market moves against your favor. Therefore, Stop Loss price level for a buy position should be lower than the open price and the current market price. On the other hand, Stop Loss price level for a sell position should be higher than the open price and the current market price.

Take Profit is to close an open position with profit as the market moves in your favor. Therefore, Take Profit price level for a buy position should be higher than the open price and current price. On the other hand, Take Profit price level for a sell position should be lower than the open price and the current market price.

- Your terminal build may be old and you may not have login to your trading account for a long time. In this case, it is necessary to install the latest version of PSS MT4 Client Terminal from our website.

- Perhaps, in your network, the port 443 is blocked and a proxy-server is used to connect to the internet. If you use the working network of an organization, this is one of most common problems. You should ask your system administrator for the proxy-server address and the port to connect to the internet and write them in the terminal settings (menu «Tools» / «Options» / «Server» / put a mark against «allow proxy-server» / click the button «proxy…» / write in the proxy-server address and port, login and password);

- 3. At your computer the program-firewall (antivirus software) blocks the 443 port. In such case, you should include PSS MT4 Client Terminal on the list of permitted programs or open the port 443.

Some bars may lack due to the loss of TCP packets (relative to a temporary loss of connection with the Internet). In such case, you need to refresh the chart (click the left mouse button on the chart / “Refresh”). By doing so, all the missing data within limits of existent history will load.

If the lacking bars have not appeared, you should:

- Close PSS MT4 Client Terminal.

- Go to the folder «history» (C:// program files / PSS MT4 Client Terminal / history);

- In the relevant folder, delete the files the names of which contain the instrument for which the bar lacks.

- Start PSS MT4 Client Terminal.

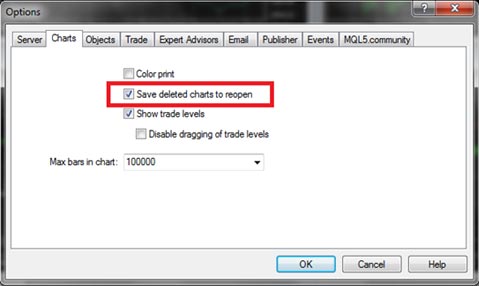

Yes, it is possible. Just make sure that the “Save deleted charts to reopen” option under the Options menu is ticked with a check.

A system of automatic updates is built into the terminal. It allows to get informed about and install new versions of the program promptly. The terminal checks for new versions of the program when it connects to the server. If a new version of any of the terminal components has been discovered, it will be automatically downloaded in the background mode.

If a client terminal has been launched in the guest mode (if the OS user has insufficient rights) however, a window requesting the increase of the user’s permissions will be shown at the attempt to update.

get in touch

- Call, email 24/7 or visit a branch

- + 47 80 06 21 53

- helpdesk@pssinvest.com

Be sure to make appointment before you visit our branch for online trading service as not all branches have a financial service specialist.