- A fully automated investment advisory service at PSS

- Advisory Robot builds, monitors and rebalances your investment portfolio.

- Start with kr 100,000. Pay no advisory fee and trading commissions.

- Builds a custom portfolio based on your goals.

- Invests in ETFs consisting of stock, forex, commodities and bonds based on your risk tolerance.

- Monitors and rebalances your portfolio automatically.

- Checks your income, spending, and tax bracket.

- Handles your daily banking requirements.

- Charges no fees for its services.

How Does Advisory Robot Work?

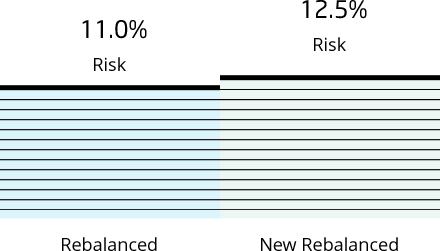

- Rising of a better investment opportunity

- Dramatic changes in incomes and expenses

- Your risk tolerances and investment appetites

Are Advisory Robots right for you?

Advisory Robots

- Ideal for a single investment goal

- Stay on track to individual goals with automated portfolio rebalancing.

- Financial planning advisors usually not provided

- Pay low fees plus automatic tax-loss harvesting.

Robo + Traditional

- Ideal for an automated portfolio created with professional guidance

- Provides access to an online planning tool to help reach your long-term goals.

- Conveniently meet with an advisor via video chat.

- Pay moderate fees for occasional financial advice.

Traditional Advisors

- Ideal for more complex services such as estate planning

- Develop a holistic view for assistance with all your financial accounts.

- Meet in-person with your dedicated advisor.

- Pay higher fees for dedicated attention and increased advisor availability.

Carefully consider the investment objectives, risks, charges and expenses before investing. A prospectus, obtained by calling + 47.80 02 48 83, contains this and other important information regarding your investment with PSS. Read carefully before investing.

Commissions and service fees may apply. Please review our commissions and fees for details.

Access to real-time data is subject to acceptance of the exchange agreements. Professional access and fees differ.

Trades executed in multiple market on the same trading day are charged a single commission. Trades partially executed over multiple trading days are subject to commission charges for each trading day.

Trading non-marginable securities may be subject to funding restrictions.

ETFs are subject to risk similar to those of their underlying securities, including, but not limited to, market, investment, sector, or industry risks, and those regarding short-selling and margin account maintenance. Some ETFs may involve international risk, currency risk, commodity risk, leverage risk, credit risk, and interest rate risk. Performance may be affected by risks associated with nondiversification, including investments in specific countries or sectors. Additional risks may also include, but are not limited to, investments in foreign securities, especially emerging markets, real estate investment trusts (REITs), fixed income, small-capitalization securities, and commodities. Each individual investor should consider these risks carefully before investing in a particular security or strategy. Investment returns will fluctuate and are subject to market volatility, so that an investor’s shares, when redeemed or sold, may be worth more or less than their original value.

Particular commission-free ETFs may not be appropriate investments for all investors, and there may be other ETFs or investment options available at PSS that are more suitable.

PSS receives remuneration from ETFs that participate in the commission-free ETF program for shareholder, administrative and/or other services.

Neither Morningstar Investment Management nor Morningstar, Inc. is affiliated with PSS and its affiliates. Morningstar, the Morningstar logo, Morningstar.com, and Morningstar Tools are either trademarks or service marks of Morningstar, Inc.

Advisory services are provided by PSS Investment Management, LLC. Brokerage services provided by Private Scandinavian Sparkasse Limited. PSS Investment Management provides discretionary advisory services for a fee.

The risk of loss in trading forex can be substantial. Clients must consider all relevant risk factors, including their own personal financial situation, before trading.

Research provided by unaffiliated third-party sources. PSS is not responsible for the products, services and policies of any third party.

All investments involve risks, including the loss of principal invested. Past performance of a security does not guarantee future results or success.

Market volatility, volume and system availability may delay account access and trade executions.

This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to, persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union.

PSS does not offer its services to persons residing in the United States of America.

Request a call from our

dedicated team today.

Let’s build a relationship.

get in touch

- Call, email 24/7 or visit a branch

- + 47 80 06 21 53

- helpdesk@pssinvest.com

Be sure to make appointment before you visit our branch for investment services as not all branches have a financial service specialist.