Moreover, your dedicated team monitors your portfolio and reports to you on a regular basis. With PSS Private Client Service, you are in control.

Not one person service, but one stop service

Your private client service specialist consist of research analysts specialized in areas like stocks, forex, bonds, ETFs, and estate planning.

Not an investment, but the management of your wealth

Private Client Service is ongoing support for your financials to maintain better lifestyle you deserve.

Not another diversified portfolio, but tailor-made investment solution by professionals.

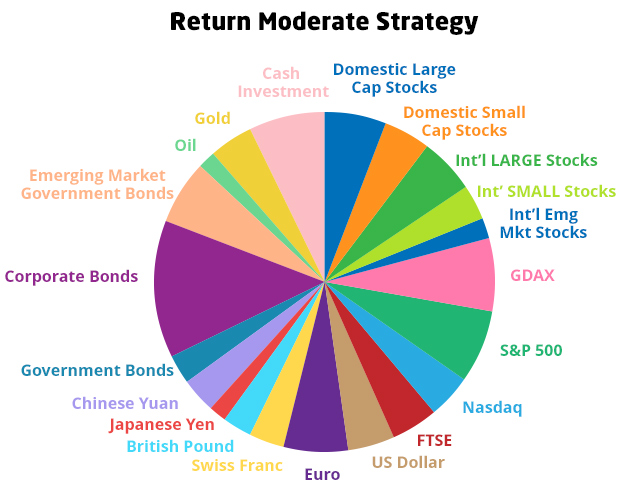

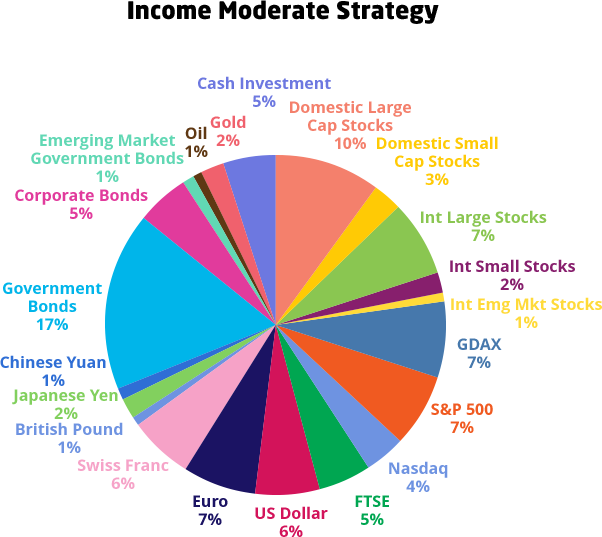

Professional asset allocation tailored for your personal situation

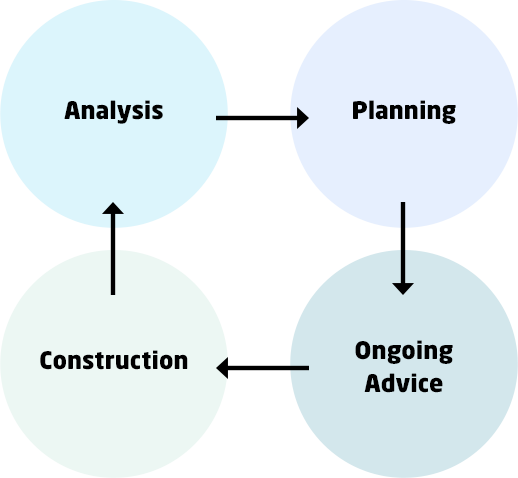

Your team is here for you. You tell us what your financial goals are and how much risk you are willing to take. Your team will list options, and you make the call if you like what you hear. Once you make a decision, you will get detailed reports and scheduled meetings at your office with you team.

Asset allocation option for Return Moderate Strategy

Private Client Service is ongoing support for your financials to maintain better lifestyle you deserve.

Asset allocation option for Income Moderate Strategy

The Private Client Advisor, Associate Private Client Advisor, and other representatives making investment recommendations in your PSS Private Client accounts are employees of PSS Private Investment Management AS.

Please read the PSS Private Client and the PSS Private Investment Management AS Disclosure Brochures for important information and disclosures about this service. Portfolio management is provided by PSS Private Investment Management AS and its affiliates.

Asset allocation and diversification strategies do not ensure a profit and do not protect against losses in declining markets.

Your account may be subject to a lower fee schedule than described above if you or someone in your household (e.g., generally a person with the same last name living at the same address) opened a PSS Private Client account before January 1, 2014, and has continuously maintained at least one PSS Private Client account since the time of that initial PSS Private Client enrollment.

Request a call from our

dedicated team today.

Let’s build a relationship.

get in touch

- Call, email 24/7 or visit a branch

- + 47 80 06 21 53

- helpdesk@pssinvest.com

Be sure to make appointment before you visit our branch for investment services as not all branches have a financial service specialist.