The PSS Trust and Credit Corp (PSS) is a savings and loan company engaged, through its subsidiaries, in securities brokerage, banking, and related financial services. Private Scandinavian Sparkasse and Credit Corp. S.A. (PSSC) is a securities broker offering investment related services. In addition, PSSC serves clients in Hong Kong through one of PSS’s subsidiaries. Other subsidiaries include Private Scandinavian Sparkasse Ltd, Private Scandinavian Sparkasse Limited and PSS Investment Management, Inc. (PSSIM), the investment advisor for PSSC’s proprietary mutual funds, which are referred to as the PSSC Funds®.

GROWTH RATE 1-Year |

||||

|---|---|---|---|---|

| Year Ended December 31, | 2021-2022 | 2022 | 2021 | 2020 |

| Client Activity Metrics:

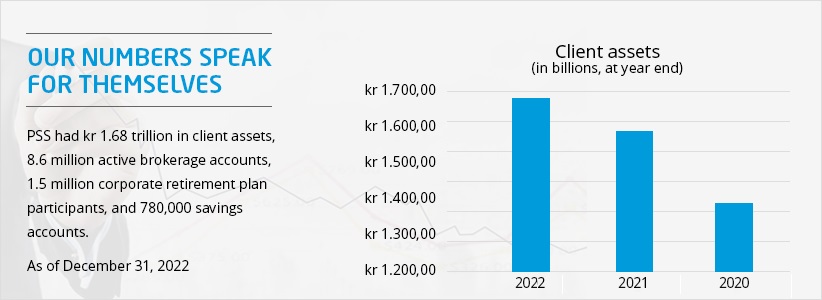

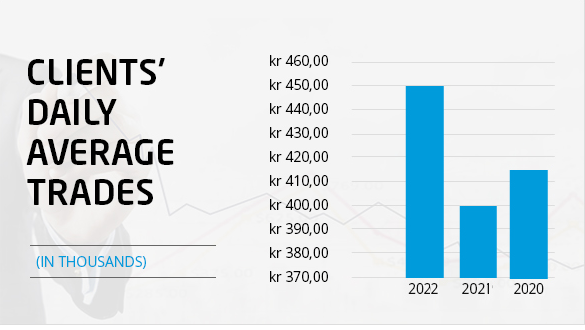

Client assets (in billions, at year end) |

7.00% 13.0t0% |

kr 1,677.70 kr 451.10 |

kr 1,574.50 kr 399.70 |

kr 1,422.60 kr 414.80 |

| Company Financial Metrics:

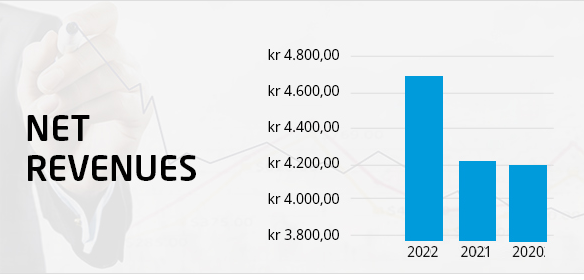

Net revenues Expenses excluding interest |

10.00% -5.00% |

kr 4,691.00 kr 451.10 |

kr 4,248.00 kr 399.70 |

kr 4,193.00 kr 414.80 |

| Income before taxes on income Taxes on income |

79.00% 62.00% |

kr 1,391.00 – kr 528.00 |

kr 779.00 – kr 325.00 |

kr 1,276.00 – kr 489.00 |

| Net income | 90.00% | kr 864.00 | kr 454.00 | kr 787.00 |

| Earnings per share – diluted Net revenue growth (decline) from prior year Pre-tax profit margin Return on stockholders’ equity Net revenue per average full-time equivalent employee (in thousands) |

84.00%

4.00% |

kr 0.70 10.00% 29.70% 12.00% kr 350.00 |

kr 0.38 1.00% 18.30% 8.00% kr 337.00 |

kr 0.68 -19.00% 30.40% 17.00% kr 338.00 |

PSS provides financial services to individuals and institutional clients through two segments – Investor Services and Institutional Services. The Investor Services segment provides retail brokerage and banking services to individual investors. The Institutional Services segment provides custodial, trading, and support services to independent investment advisors (IAs). The Institutional Services segment also provides retirement plan services, specialty brokerage services, and mutual fund clearing services. For financial information by segment for the three years ended December 31, 2022. Segment Information.” As of December 31, 2022, PSS had full-time, part-time and temporary employees, and persons employed on a contract basis that represented the equivalent of about 14,100 full-time employees.

OUR PURPOSE

PSS exists to transform lives through investing for the better. That is our purpose and our rally cry for everything we do, say and embody. It gives us a clear sense of responsibility. We use our assets, scale, and people for a greater good. By fulfilling our purpose, we can positively transform lives and make a real impact in the world.

Our Story

The arrival of the 21st century has seen the financial service industry change almost beyond recognition through innovations in information technology. The world has ‘shrunk’ and demand for less-centralized financial services is increasing rapidly.

PSS opened its doors as PSS Trust and Credit Corp. disrupting the industry ever since through removal of the cost barrier, making investing accessible, understandable, and financially rewarding for everyone. Innovation has been at the core of everything we do.

Today, we continue to look for ways to make a meaningful impact in the industry and beyond. We believe in our collective power to transform lives and invest for the better.

OUR VALUE

People Matter

We treat others with courtesy, dignity, respect, and have a high regard for diversity. We help each other and our communities to grow and succeed.

Client Driven

We listen to each client and are empowered to

deliver solutions that best fit their individual and unique needs. We aspire to deliver client experiences and interactions we are proud to stand behind.

Meaningful Innovation

We actively challenge the status quo with creative thinking while embracing new methods, tools, and technologies. We take smart, calculated risks based on disciplined thinking and judgment. We welcome change as a means to a better way.

our ceo is back

Yes, Joseph J. Deiss is back. That’s news. But we’ve done more than just bring back a CEO. We’ve brought back what made PSS successful in the first place.

THINGS ARE DIFFERENT NOW

Refocusing on our core franchise and exiting banking sector, simplifying and streamlining our organization and client offerings, and improving our value propositions.

2023 Annual Report is in

See our latest earnings, cash flows, and acquisitions.

Our Annual Revenues Growth

Our international offices

Norway HQ

- + 47 80 06 21 53

- Biskop Gunnerus Gate 14, 0185 Oslo, Norway

Demark RO

- + 45 78 73 09 99

- Arne Jacobsens Alle 7, 2300 Copenhagen, Denmark

Sweden RO

- + 46 10 884 8106

- Klarabergsgatan 29 111 21 Stockholm Sweden

Finland RO

- + 358 30 6230334

- Mannerheiminaukio 1, 00100 Helsinki, Finland

Hong Kong RO

- + 852 5808 3903

- 99 Queens Rd. Central, Hong Kong, Hong Kong

United Kingdom RO

- + 44 20 3807 2284

- 100 Bishopsgate, London, EC2N 4AG, GBR

get in touch

- Call, email 24/7 or visit a branch

- + 47 80 06 21 53

- helpdesk@pssinvest.com

Be sure to make appointment before you visit our branch for online trading service as not all branches have a financial service specialist.